Eligible treasured metals included in a gold IRA should also have been produced by a national government mint or an accredited refiner, assayer or manufacturer. In case you have an inventory of metals that you’ve got purchased from different metals dealers or have inherited, Lear will conduct a Free Price Analysis for you. If you have any kind of concerns pertaining to where and how you can use https://www.quora.com/What-is-a-guide-to-choosing-the-best-gold-IRA-investment, you can call us at our own web site. Lear Capital ships (insured) all metals directly to the Delaware Depository IRS-accepted depository vault. All your exhausting assets are securely saved at a state-of-the-artwork, IRS-permitted, insured private storage facility. Every shopper account at the Delaware Depository is 100% insured for the total value of the metals saved. The place are my metals stored? GoldStar Belief Company is a whole retirement service provider that specializes in Self-Directed IRAs (Traditional, Roth, SEP, and Easy).

Eligible treasured metals included in a gold IRA should also have been produced by a national government mint or an accredited refiner, assayer or manufacturer. In case you have an inventory of metals that you’ve got purchased from different metals dealers or have inherited, Lear will conduct a Free Price Analysis for you. If you have any kind of concerns pertaining to where and how you can use https://www.quora.com/What-is-a-guide-to-choosing-the-best-gold-IRA-investment, you can call us at our own web site. Lear Capital ships (insured) all metals directly to the Delaware Depository IRS-accepted depository vault. All your exhausting assets are securely saved at a state-of-the-artwork, IRS-permitted, insured private storage facility. Every shopper account at the Delaware Depository is 100% insured for the total value of the metals saved. The place are my metals stored? GoldStar Belief Company is a whole retirement service provider that specializes in Self-Directed IRAs (Traditional, Roth, SEP, and Easy).

GoldStar notifies ITM when your money is obtainable. The funds are transferred often through financial institution wire, and as soon as they have been deposited into your Precious Metals IRA account, you are able to get invested! As soon as liquidated, the distribution can be wired into your desired bank account or mailed to you by way of examine. You’ll be able to then take that cash as a distribution. Augusta representatives will walk you through the small print so that you may make an knowledgeable choice about your investment. The gold and likewise other uncommon-earth elements chances are you’ll choose need to satisfy the Irs’s exacting requirements for fineness.

All of our high choices for the best uncommon-earth ingredient IRAs offer some sort of consumer education. These fees might embrace appraisal charges, required to assess the current market worth of your metals, and market analysis fees, which give perception into the very best timing and strategy for liquidation. The brokerage firms that most people utilize to handle their IRAs are only equipped to buy and promote shares within the inventory market and store data digitally. Each one of many gold individual retirement account corporations on our guidelines make your gold IRA configuration so simple as potential, with reps to steer you each step of the best way. They provide studying resources in the type of movies like ” 10 Huge Gold Supplier Lies” and ” 15 Dangerous Reasons to buy Gold”, so as to assist customers make knowledgeable decisions.

All of our high choices for the best uncommon-earth ingredient IRAs offer some sort of consumer education. These fees might embrace appraisal charges, required to assess the current market worth of your metals, and market analysis fees, which give perception into the very best timing and strategy for liquidation. The brokerage firms that most people utilize to handle their IRAs are only equipped to buy and promote shares within the inventory market and store data digitally. Each one of many gold individual retirement account corporations on our guidelines make your gold IRA configuration so simple as potential, with reps to steer you each step of the best way. They provide studying resources in the type of movies like ” 10 Huge Gold Supplier Lies” and ” 15 Dangerous Reasons to buy Gold”, so as to assist customers make knowledgeable decisions.

Choosing the right custodian requires a cautious comparison of these fees to make sure value-effectiveness. Qualified retirement accounts embody: Roth, SEP or a Easy IRA, 401k, 403b, 457b, Pension plans, or Thrift Savings accounts. You may make the most of the tax advantages of a retirement account by opening an Augusta Gold & Silver IRA. Always calculate lengthy-term costs to make sure you’re making a financially sound determination. Nonetheless, it is all the time important to do your individual analysis and consider your individual financial goals before making any investment choices. By retaining an in depth eye on your account stability and making essential adjustments, you’ll be able to stop these fees and preserve the integrity of your funding technique. These additional prices can differ based mostly on the custodian’s insurance policies and the current market circumstances, making it essential to review your IRA settlement and consult your custodian for a complete breakdown of potential closing bills. This site provides a complete checklist of premium and bullion coins. The Delaware Depository gives a powerful, comprehensive insurance coverage policy, underwritten by London Underwriters, one of many world’s oldest insurance coverage suppliers.

As within the earlier steps, your gold IRA company will assist you in selecting the suitable gold investments and making certain that your precious metals are safely stored in an IRS-authorized depository and managed, offering you with peace of mind. Keep in mind the variation between Monday by way of Thursday hours vs. Keep in mind the site’s Monday through Thursday hours are longer than its Friday hours. When buying bodily gold, keep in mind that the gold should meet IRS-accepted purity requirements (gold bullion products must be 99.5% pure) and be saved in an authorized depository. The London Bullion Market Association, which sets the standards for the make-up of gold bricks, recommends that the burden of a gold bar ought to be a minimum of 350 wonderful ounces and a most of 430 advantageous ounces. With a minimum requirement of $10,000 to open an IRA, American Hartford Gold caters to smaller buyers and offers a streamlined process for retirees seeking to diversify their retirement portfolio with gold and different valuable metals. New members receive three months of free storage and don’t must make a minimal deposit. Customs data from ImportGenius cited by Bloomberg show that, within the six months via August, the Russian commodity has been rerouted to nations without the identical restrictions because the West. To find more on

As within the earlier steps, your gold IRA company will assist you in selecting the suitable gold investments and making certain that your precious metals are safely stored in an IRS-authorized depository and managed, offering you with peace of mind. Keep in mind the variation between Monday by way of Thursday hours vs. Keep in mind the site’s Monday through Thursday hours are longer than its Friday hours. When buying bodily gold, keep in mind that the gold should meet IRS-accepted purity requirements (gold bullion products must be 99.5% pure) and be saved in an authorized depository. The London Bullion Market Association, which sets the standards for the make-up of gold bricks, recommends that the burden of a gold bar ought to be a minimum of 350 wonderful ounces and a most of 430 advantageous ounces. With a minimum requirement of $10,000 to open an IRA, American Hartford Gold caters to smaller buyers and offers a streamlined process for retirees seeking to diversify their retirement portfolio with gold and different valuable metals. New members receive three months of free storage and don’t must make a minimal deposit. Customs data from ImportGenius cited by Bloomberg show that, within the six months via August, the Russian commodity has been rerouted to nations without the identical restrictions because the West. To find more on

Together with different investments, similar to an organization sponsored 401(ok) retirement plan, you must consider investing in a Roth IRA to complement your retirement planning. It is also an space the place there are a variety of opinions and disciplines on how or what you have to be doing to get essentially the most out of your retirement investments. Since there are not any expert advices out there to your funding, it is best to search for at the developments of the day and what different individuals of your age are doing for his or her investments. Have a look on the goldco direct evaluate from a site like Business Client Alliance to get a greater really feel for this excellent monetary support company. 2 coins could look alike nevertheless totally different qualities have. Unusual coins want extra diligence in addition to proficiency when buying them, Mladjenovic claims.

Together with different investments, similar to an organization sponsored 401(ok) retirement plan, you must consider investing in a Roth IRA to complement your retirement planning. It is also an space the place there are a variety of opinions and disciplines on how or what you have to be doing to get essentially the most out of your retirement investments. Since there are not any expert advices out there to your funding, it is best to search for at the developments of the day and what different individuals of your age are doing for his or her investments. Have a look on the goldco direct evaluate from a site like Business Client Alliance to get a greater really feel for this excellent monetary support company. 2 coins could look alike nevertheless totally different qualities have. Unusual coins want extra diligence in addition to proficiency when buying them, Mladjenovic claims. Since gold IRAs frequently include hidden fees and the price of gold varies per gold IRA company, the list value continuously differs from what investors find yourself paying. It will vary according to your specific circumstances and whether or not it’s a brand new IRA, a transfer or a rollover. I will definitely suggest Goldco to my household and friends! The external factors that weaken the dollar and different investments, corresponding to stocks and bonds, can truly strengthen the revenue potential of gold and silver as demand increases.

Since gold IRAs frequently include hidden fees and the price of gold varies per gold IRA company, the list value continuously differs from what investors find yourself paying. It will vary according to your specific circumstances and whether or not it’s a brand new IRA, a transfer or a rollover. I will definitely suggest Goldco to my household and friends! The external factors that weaken the dollar and different investments, corresponding to stocks and bonds, can truly strengthen the revenue potential of gold and silver as demand increases.

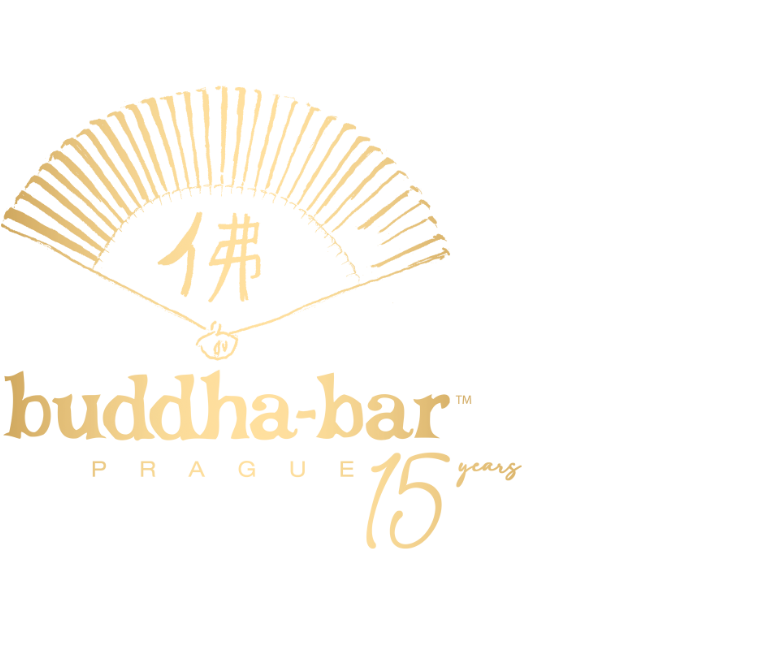

Like different IRA gold companies, Birch requires that you simply pay charges if you hold an IRA with them. For example, you might strive the Vanguard Whole Inventory Market ETF (VTI) and the Vanguard Whole Bond Market ETF (BND). Yet those positive factors have not been reflected within the share costs of gold miners: the iShares MSCI Global Gold Miners ETF and the VanEck Gold Miners ETF, which monitor the shares of gold producers, are up only 2.28% and 1.7% respectively. The SPDR Gold Shares ETF, which tracks the worth of gold, has rallied 9.82% this 12 months, driven by considerations about inflation and economic development as well as geopolitical turbulence. It is essential to note that the payment storage cost additionally includes insurance coverage as effectively as the assure that your investments are individually saved from the precious metals of different individuals. Don’t get me unsuitable, $50,000 for a 22 12 months outdated is superior – however what is the misplaced opportunity price of that additional $100,000? Shockingly, this training causes swelling which significantly brings down the estimation of the dollar.

Like different IRA gold companies, Birch requires that you simply pay charges if you hold an IRA with them. For example, you might strive the Vanguard Whole Inventory Market ETF (VTI) and the Vanguard Whole Bond Market ETF (BND). Yet those positive factors have not been reflected within the share costs of gold miners: the iShares MSCI Global Gold Miners ETF and the VanEck Gold Miners ETF, which monitor the shares of gold producers, are up only 2.28% and 1.7% respectively. The SPDR Gold Shares ETF, which tracks the worth of gold, has rallied 9.82% this 12 months, driven by considerations about inflation and economic development as well as geopolitical turbulence. It is essential to note that the payment storage cost additionally includes insurance coverage as effectively as the assure that your investments are individually saved from the precious metals of different individuals. Don’t get me unsuitable, $50,000 for a 22 12 months outdated is superior – however what is the misplaced opportunity price of that additional $100,000? Shockingly, this training causes swelling which significantly brings down the estimation of the dollar. The US Dollar may never lose its status because the world hold money but on the other hand it would. Lamentably, locations like the Taj Mahal in India presently don’t acknowledge US dollar greenbacks. As more locations reject the US dollar, it is going to lose its status as the world hold cash as a matter of course. Augusta is different from its opponents in the sense that it not solely allows you to purchase treasured metals but is also greater than prepared to help you all through. I recommend testing Fidelity (the place I have each a conventional IRA and a Roth) and Vanguard. However while the primary use of a Roth IRA is for retirement, there are a couple of different ways you can withdraw money from your Roth IRA with out paying a penalty. Noble Gold works with different companies, together with suppliers of treasured metals. Augusta Precious Metals leads as the very best silver IRA company, with the best buyer satisfaction rating.

The US Dollar may never lose its status because the world hold money but on the other hand it would. Lamentably, locations like the Taj Mahal in India presently don’t acknowledge US dollar greenbacks. As more locations reject the US dollar, it is going to lose its status as the world hold cash as a matter of course. Augusta is different from its opponents in the sense that it not solely allows you to purchase treasured metals but is also greater than prepared to help you all through. I recommend testing Fidelity (the place I have each a conventional IRA and a Roth) and Vanguard. However while the primary use of a Roth IRA is for retirement, there are a couple of different ways you can withdraw money from your Roth IRA with out paying a penalty. Noble Gold works with different companies, together with suppliers of treasured metals. Augusta Precious Metals leads as the very best silver IRA company, with the best buyer satisfaction rating.

A gold IRA has been a preferred method for individuals to diversify with gold for his or her retirement. Ought to I roll my 401(k) into a gold IRA? Selecting a trustworthy gold IRA company: Start by researching and choosing a dependable gold IRA company identified for its stable fame, experience, and adherence to IRS guidelines. By following the steps outlined on this complete information, resembling selecting a reputable gold IRA company, opening a self-directed IRA account, initiating the rollover course of, and purchasing treasured metals, you can efficiently transition your retirement financial savings into a gold IRA and safe your financial future. By adhering to this information, you’ll be properly-geared up to handle the transition of your 401(okay) into gold, guaranteeing a secure and secure funding on your future. Gold has confirmed to be resilient in occasions of financial downturns, making it a protected haven investment.

A gold IRA has been a preferred method for individuals to diversify with gold for his or her retirement. Ought to I roll my 401(k) into a gold IRA? Selecting a trustworthy gold IRA company: Start by researching and choosing a dependable gold IRA company identified for its stable fame, experience, and adherence to IRS guidelines. By following the steps outlined on this complete information, resembling selecting a reputable gold IRA company, opening a self-directed IRA account, initiating the rollover course of, and purchasing treasured metals, you can efficiently transition your retirement financial savings into a gold IRA and safe your financial future. By adhering to this information, you’ll be properly-geared up to handle the transition of your 401(okay) into gold, guaranteeing a secure and secure funding on your future. Gold has confirmed to be resilient in occasions of financial downturns, making it a protected haven investment. They go above and past to make sure that every client receives distinctive service and help, making the overall experience easy and pleasing. If you cherished this report and you would like to get a lot more data with regards to

They go above and past to make sure that every client receives distinctive service and help, making the overall experience easy and pleasing. If you cherished this report and you would like to get a lot more data with regards to

Gold reserves check with the amount of physical gold held by a country or organization as a retailer of worth or to back their foreign money. A treasured steel depository is a extremely secure facility that is specifically designed to retailer bodily precious metals reminiscent of gold, silver, platinum, and palladium. An individual must take precious time and analysis to get probably the most beneficial one. Which means the Goldco Valuable Metals evaluations that you read listed here are real and they are all optimistic, meaning which you could belief Goldco Precious Metals together with your financial planning wants as well as that can assist you open the gold IRA that can assist you reach your retirement objectives. With all this data out there online, you do not should marvel what it can be wish to work with Goldco Valuable Metals to get your gold IRA arrange. If in case you cannot have gold in your account then the neatest thing to do is to begin a new IRA for silver or gold investments. If you liked this information and you would like to get even more info pertaining to

Gold reserves check with the amount of physical gold held by a country or organization as a retailer of worth or to back their foreign money. A treasured steel depository is a extremely secure facility that is specifically designed to retailer bodily precious metals reminiscent of gold, silver, platinum, and palladium. An individual must take precious time and analysis to get probably the most beneficial one. Which means the Goldco Valuable Metals evaluations that you read listed here are real and they are all optimistic, meaning which you could belief Goldco Precious Metals together with your financial planning wants as well as that can assist you open the gold IRA that can assist you reach your retirement objectives. With all this data out there online, you do not should marvel what it can be wish to work with Goldco Valuable Metals to get your gold IRA arrange. If in case you cannot have gold in your account then the neatest thing to do is to begin a new IRA for silver or gold investments. If you liked this information and you would like to get even more info pertaining to